How Much House Can You Comfortably Afford?

Buying a home is one of the biggest decisions you’ll ever make. And honestly, the question that keeps almost everyone awake is simple: “How much house can I actually afford?”

It sounds like a straightforward question, but there’s a lot hiding underneath it—your income, monthly expenses, down payment, interest rates, and even how comfortable you feel with long-term payments. One wrong move and you’re stuck with a monthly bill that crushes the joy out of owning a home.

Here’s the good news: you don’t have to guess.

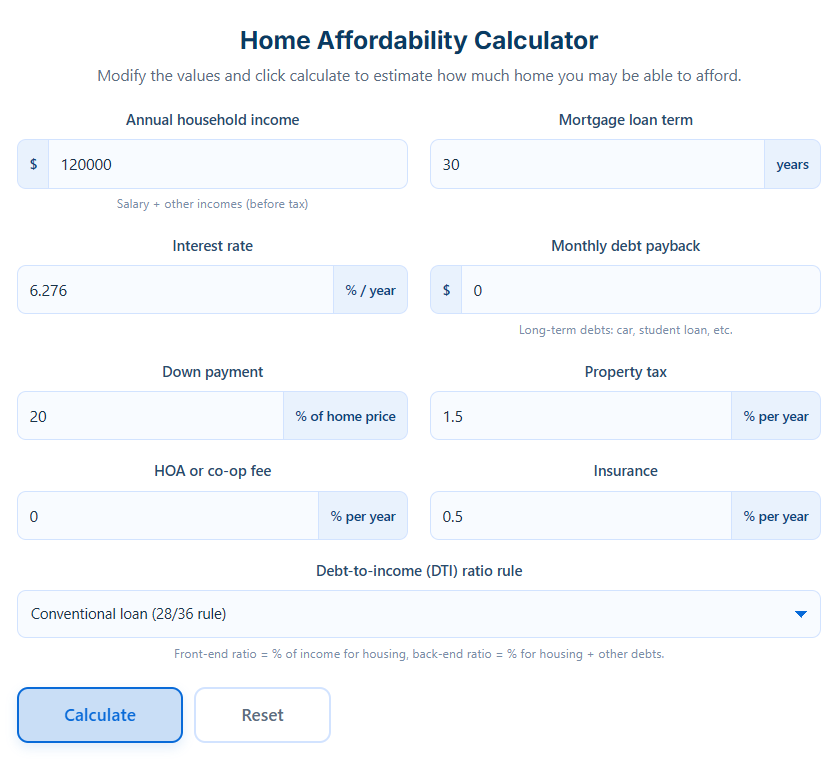

You can use our home loan affordability calculator to get a clear, realistic number based on your financial details—even if you’re buying for the first time. It’s free, it’s fast, and you’ll get answers without digging through confusing loan formulas.

And because you’re already here, this guide will walk you through everything you need to know—step by step. You can even try the tool right now on Free Calculation Tools, where we simplify the confusing stuff so you can make smarter decisions.

So, grab a cup of coffee. Let’s figure out the real number behind “How much house can I afford?”

What Is a Home Loan Affordability Calculator?

(Focus Keyword Used: home loan affordability calculator)

A home loan affordability calculator is a simple online tool that tells you how much house you can realistically afford based on your income and expenses. Instead of guessing—or relying on bank estimates—you get a personalized number that fits your financial life.

Think of it like this: you plug in your income, your monthly bills, your down payment, and the interest rate you expect from the bank. The calculator then works out the math that normally takes financial advisors or mortgage experts to explain.

What It Actually Helps You With

You’ll be able to see:

- The maximum home price you can safely afford

- How much your monthly mortgage payment might be

- How interest rate changes affect your budget

- Whether you need a bigger down payment

- If your current income is enough for the house you want

People use a home affordability calculator because it gives a clear picture before talking to banks or agents. It saves time, reduces stress, and helps you avoid taking on a loan that’s simply too big.

Why It Matters So Much

Buying a home is emotional. It’s easy to fall in love with something outside your budget. This tool brings you back to reality—in a good way. It keeps you safe and helps you make a strong financial decision, not an emotional one.

How Does It Work?

A home loan affordability calculator uses a few key numbers to show what you can afford. Don’t worry—there’s no complicated math on your side. You’ll just enter your details, and the calculator handles everything behind the scenes.

Here’s how it works in simple steps:

1. You Enter Your Income

This includes your monthly salary or combined household income.

The calculator uses this to understand how much you can comfortably spend each month.

2. You Add Your Monthly Expenses

This includes credit card payments, car loans, and any other regular bills.

These numbers tell the calculator how much “room” you have left in your budget.

3. You Choose Your Down Payment

A higher down payment means a smaller loan—and easier monthly payments.

Even a small change here can make a big difference.

4. You Select an Interest Rate

Interest rates change often.

You can use current market rates or your bank’s latest offer.

The calculator updates your results instantly.

5. You Get Your Estimated Home Price

This is the part everyone loves.

The calculator gives you:

- The total house price you can afford

- Your estimated monthly mortgage payment

- How long your loan term affects your payment

- A breakdown showing what influences the final number

It’s fast. It’s simple. And it gives you clarity you can actually trust.

Key Features of a Good Home Affordability Calculator

A great home loan affordability calculator doesn’t just throw random numbers at you. It gives you information you can act on. Here’s what the best calculators (including ours) offer:

✔ Easy to Use

You don’t need financial knowledge. Simply enter your details and hit calculate.

✔ Accurate Results

The tool uses real-world formulas based on standard mortgage rules.

✔ Instant Updates

Change the interest rate or down payment and see the results refresh immediately.

✔ Mobile-Friendly

So you can check affordability on your phone while visiting properties.

✔ Free and Unlimited

You can calculate as many times as you want without sign-ups.

✔ Realistic Budget Guidance

The tool doesn’t push you into risky loan amounts.

It gives you a safe, comfortable estimate.

These features help you make smarter decisions, especially if you’re buying your first home.

Benefits of Using Free Calculation Tools

There are many calculators online—but Free Calculation Tools stands out for a reason.

Here’s why thousands of users prefer our platform:

1. Completely Free

No paywalls. No subscriptions. No tricky sign-ups.

You get full access instantly.

2. Fast and Simple

Everyone is busy. That’s why our calculators give results in seconds.

3. Reliable and Accurate

We use industry-standard formulas so the results match what lenders expect.

4. Clean, Modern Layout

No clutter. No ads blocking the screen. You get a smooth experience.

5. Helps You Plan Your Future

Whether you’re buying your first house or exploring “How much can you spend on a house,” you’ll get answers that actually help.

6. Works for All Budgets

You can test different incomes, down payments, or interest rates to find your comfort zone.

Our mission is simple: make hard calculations easy for everyone.

Who Can Use This Tool?

The home loan affordability calculator is designed for anyone thinking about buying a home.

It’s simple enough for beginners and powerful enough for professionals.

✔ First-Time Home Buyers

They want to know if their dream home is realistic. This calculator gives honest answers.

✔ Families Planning an Upgrade

Maybe you need more space. The tool shows how much bigger you can go.

✔ Real Estate Investors

Investors use it to check if a property fits their financial strategy.

✔ Students or Young Professionals

Even if you’re not buying right now, running the numbers helps you plan ahead.

Real-World Example #1:

Maria earns a steady salary but isn’t sure if she can buy a house alone. She uses the calculator and learns that she’s closer than she thought.

Real-World Example #2:

A young couple uses the calculator to compare two interest rates. The difference saves them thousands in the long run.

Comparison With Alternatives

When you’re trying to figure out how much house you can afford, you’ll probably run into different tools—mortgage calculators, EMI calculators, and even basic monthly payment tools. They all help in their own way, but they’re not the same as a home loan affordability calculator.

Here’s a simple breakdown so you can see the difference clearly and decide which tool actually fits your needs.

Why You Need the Right Tool

A lot of tools online only answer one question:

“What will my monthly payment be?”

But that’s not what you’re asking.

You’re asking something far more important:

“What is the maximum home price I can afford without stressing my finances?”

That’s why this calculator matters more. It starts from your financial life—not from the home price.

Comparison Table

Below is a quick and simple comparison between the most common tools you’ll find online:

| Tool Type | What It Does | Best For | Limitations |

|---|---|---|---|

| Home Loan Affordability Calculator (Recommended) | Calculates the maximum home price based on income, expenses, down payment, interest rate | First-time buyers, families, planners | None — most complete tool |

| Mortgage / EMI Calculator | Calculates monthly payment after you already know the home price | Checking payment amounts | Doesn’t tell you how much you can afford |

| Simple Budget Calculator | Helps you understand your income vs. monthly expenses | Budget planning | Doesn’t calculate home price or loan affordability |

| Bank Prequalification Tools | Gives rough estimates based on rules | People ready to talk to banks | Can be inaccurate, often requires sign-up |

Why Our Calculator Outperforms Alternatives

Here’s the thing: when you’re buying a home, you don’t want guesswork. You want numbers that reflect your real situation.

Our home loan affordability calculator gives you:

- A complete picture, not just payment estimates

- Realistic affordability boundaries

- Flexibility to test different scenarios

- Instant results without sign-up

- A user-friendly layout even beginners can understand

Other tools might be good for quick checks, but they don’t answer the core question:

“How much house can I afford based on my life and income?”

This calculator does exactly that—accurately and quickly.

Frequently Asked Questions

Home buying can feel overwhelming. Here are some of the most common questions people ask when using a home loan affordability calculator, answered in a simple and friendly way.

1. Is the calculator free to use?

Yes—completely free. You don’t need to create an account, enter personal details, or pay anything. You can calculate as many times as you want.

2. How accurate are the results?

Very accurate. The calculator follows standard mortgage formulas used by banks and lenders. Of course, final approval depends on your bank—but this gives a very close estimate.

3. Do interest rates really make a big difference?

Absolutely. Even a small change can add or remove thousands over the lifetime of your loan. That’s why the calculator lets you adjust interest rates to see the impact instantly.

4. Will this calculator tell me my exact loan amount?

It gives you a highly reliable estimate. The final number depends on your bank’s evaluation, but the calculator prepares you with a strong understanding before applying.

5. Is my information stored or saved?

No. Nothing is stored, saved, or shared. Everything stays on your screen.

6. Can I use it if I’m buying with a partner or spouse?

Yes! You can combine incomes and expenses to get a clearer picture of what you can afford as a household.

7. What if my income isn’t the same every month?

You can enter your average monthly income to get a realistic number. If your income varies a lot, try entering two numbers—one with your minimum income and one with your average income—to compare.

8. What if I don’t know my down payment yet?

The calculator still works. You can test different down payment amounts (like 10%, 20%, or 30%) to see how each option changes your results.

9. Is this calculator only for first-time buyers?

Not at all. Anyone can use it—investors, families upgrading their home, or even people planning their future purchase.

10. Does the calculator show monthly mortgage payments too?

Yes. Along with the affordability estimate, you can also see monthly payment predictions, making it easier to check if the number fits your budget comfortably.

Here’s the thing: figuring out how much house you can afford shouldn’t feel like decoding a secret formula. Buying a home is already a huge emotional step—you shouldn’t also be stuck guessing numbers or relying on salespeople to tell you what fits your budget. You deserve transparency. You deserve clarity. And you deserve a tool that actually works for your life, not some generic estimate everyone gets.

That’s exactly what the home loan affordability calculator gives you. It takes your income, your monthly expenses, your interest rate, and your comfort level—and turns all of that into something simple and understandable. Instead of stressing over “What if I choose a home I can’t handle?” you get a number that gives you real confidence.

Think about it. When you know your affordability range upfront, everything becomes easier:

- You shop for homes that actually fit your budget

- You avoid loans that stretch you too thin

- You understand how interest rates affect your monthly payments

- You control the buying process instead of letting others decide for you

Most importantly, you get peace of mind. No more anxiety. No guesswork. Just clear, honest numbers.

And the best part? You don’t have to download anything, sign up for anything, or wait for a bank to respond. You can calculate your affordability right now, in seconds, on a tool built to keep things simple.

Buying a home is one of the most exciting steps in life. Let this be the moment where things start making sense—where the numbers finally support your dreams instead of standing in your way.

Ready to See How Much House You Can Actually Afford?

Don’t wait. Your perfect number is just one calculation away.

👉 Try the Home Loan Affordability Calculator Now

It’s free. It’s fast. And it’s built to help you make smarter decisions.

Whether you’re buying your first home, planning an upgrade, or just exploring your options, this tool gives you the clear financial picture you’ve been looking for. Run your numbers today and take your next step with confidence.