Car Insurance Calculator: Estimate Your Real Coverage Cost

If you’ve ever sat in front of your computer staring at endless insurance forms, wondering “Why does this cost so much?” — you’re not alone. Buying car insurance can feel confusing, especially when every provider promises “the best deal.” That’s exactly where a car insurance calculator steps in. It cuts through the clutter and gives you a clear, quick estimate of what you’ll actually pay based on your real-life details.

Think of it as your personal car insurance cost estimator. You enter your car model, location, age, and coverage preferences, and within seconds, you see what’s fair — not just what’s advertised. It’s like checking the restaurant bill before ordering dessert — you already know what you’re getting into.

And here’s the thing: most people overpay simply because they don’t compare enough quotes. A good insurance cost estimator like the one on Free Calculation Tools saves you time and money by showing you estimates instantly — no phone calls, no confusing forms, and definitely no pushy agents.

Honestly, once you use it, you’ll wonder why you ever tried to calculate premiums manually. The calculator is designed for everyone — from a first-time car buyer trying to budget responsibly to a seasoned driver curious about switching insurers.

So, if you’re tired of insurance guesswork, buckle up. In this guide, we’ll walk through exactly what a car insurance calculator is, how it works, and why it’s one of the smartest financial tools you can use before you renew or buy a policy.

What Is a Car Insurance Calculator?

A car insurance calculator is an online tool that estimates how much you’ll pay for your car insurance premium. Instead of manually calling different insurers or scrolling through endless price lists, this tool uses algorithms to calculate your estimated cost in seconds.

Here’s a simple way to picture it: imagine you’re shopping for clothes online. You select your size, color, and style, and the site instantly shows what fits your preferences and budget. A car insurance calculator works the same way — only instead of jeans, you’re customizing your insurance coverage.

The tool factors in things like:

- Car make and model (because newer or luxury models usually cost more to insure)

- Location or ZIP code (urban areas often have higher risk factors)

- Driver’s age and experience (young drivers typically pay higher premiums)

- Type of coverage (third-party, comprehensive, etc.)

By pulling all this together, the calculator gives you a near-accurate picture of what you can expect to pay — before you even contact an insurance agent.

And here’s the best part: when you use Free Calculation Tools, the calculator doesn’t just estimate; it educates. You get a transparent breakdown of why your premium is high or low, so you can make smarter choices when adjusting coverage options.

Example:

Ali drives a 2022 Honda Civic in Dubai and enters his details. The calculator instantly shows him a realistic quote range — no hidden surprises, no extra math. Compare that to his friend Sara, who drives an older Toyota in a smaller town. Her estimate comes out much lower. That’s the power of personalized calculation — no two results are the same, and that’s what makes it so helpful.

How It Works (Step by Step)

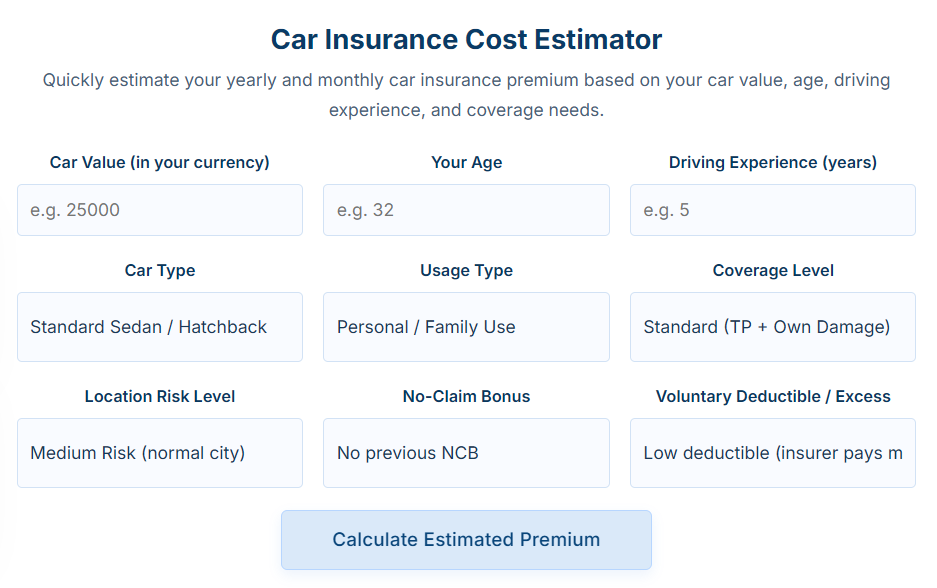

Here’s a quick, easy-to-follow look at how the car insurance cost estimator works:

- Enter Basic Information

Start with your car’s make, model, and year. Add your city, age, and driving history. It’s just a few quick fields — no paperwork or phone numbers required. - Select Your Coverage Type

Choose whether you want comprehensive (which covers damage to your car and others’) or third-party (which only covers damage you cause to someone else’s vehicle). - Adjust Add-Ons or Extras

Some calculators, including Free Calculation Tools, let you include extras like roadside assistance or rental-car cover. These small tweaks can change the premium slightly, so it’s worth experimenting. - Click Calculate — and Done!

Within seconds, you’ll see your estimated premium cost. You’ll also get a clear summary of how the price was determined — something most insurance agents never explain.

That’s it. No waiting for an email quote. No long phone calls. Just clarity.

Plus, if you decide to refine your results — say you switch from full coverage to basic liability — you can do it instantly. It’s quick, smart, and completely free.

When you use the insurance cost estimator on Free Calculation Tools, you’re not just seeing numbers; you’re learning what influences them. You’ll spot patterns: maybe your premium drops when you increase your deductible or rises when you add a younger driver. Understanding these insights helps you control costs and stay within your budget.

Key Features You’ll Love

Let’s be real — most online tools promise “instant results,” but few actually make life easier. The car insurance calculator at Free Calculation Tools does. It’s designed to feel smooth, quick, and genuinely useful. Here’s what sets it apart:

- Instant Estimates – You don’t need to wait for an email or sales call. The calculator crunches the numbers and gives you a near-accurate cost within seconds.

- Smart Algorithms – It adjusts results based on dozens of real-world factors: age, region, accident history, and even car type. You’ll notice how one tiny change, like switching from an SUV to a sedan, updates your estimate instantly.

- Simple Layout – No clutter, no confusing buttons. Everything fits neatly on one screen so you can focus on what matters — your cost.

- Customizable Inputs – Whether you want to add roadside assistance or increase your deductible, the tool lets you play around freely and see how each option affects your premium.

- Completely Free – No sign-ups, no hidden fees, no “trial period.” Just open the page and start calculating.

- Responsive on All Devices – Whether you’re on your laptop, phone, or tablet, the design adjusts automatically.

You’ll notice the moment you try it — everything feels built for humans, not spreadsheets. The tool takes what used to be a tedious, paper-based task and turns it into something even a beginner can do with confidence.

Benefits of Using Free Calculation Tools

So, why choose Free Calculation Tools over any other random website offering a calculator? Simple — it’s built on accuracy, transparency, and trust.

1. Clarity Without Compromise

Unlike other sites that bury you in pop-ups or ask for contact details, this platform values your time and privacy. You open the calculator, add your info, and get a clean result — that’s it.

2. Confidence in Every Click

When you use this car insurance cost estimator, you’re not guessing. You’re seeing a realistic range based on your personal data. That confidence helps you make smarter financial decisions — especially when renewing your insurance or switching providers.

3. Learn While You Calculate

Every result gives you a short explanation of why the premium looks that way. Maybe it’s your car’s market value, your driving record, or your city’s traffic risk. Either way, you’ll understand what drives the price up or down.

4. Save More Than Time

Let’s face it — money matters. By comparing coverage levels, you can often save hundreds per year. The calculator makes it effortless to test scenarios: “What if I drop collision coverage?” or “What if I raise my deductible?”

5. Total Accessibility

No login barriers, no payment screens, no hidden tricks. You can share the link https://freecalculationtools.com/car-insurance-cost-estimator/ with friends or family, and they’ll see results just like you.

And honestly, that’s the biggest advantage — you’re not just estimating; you’re empowered. It’s a small step that can lead to better financial choices down the road.

Who Can Use It? (With a Real Example)

The beauty of the insurance cost estimator is that anyone who drives a car can use it. There’s no minimum experience required — if you know your car model and where you live, you’re good to go.

Here are a few people who’ll benefit most:

- New Drivers: Perfect for students or first-time car owners who want to understand what insurance might cost before buying a vehicle.

- Busy Professionals: If you don’t have time for endless phone quotes, this tool gives you results between coffee breaks.

- Families: Great for comparing insurance costs on multiple cars in the same household.

- Fleet Owners: Small business owners can check how coverage scales when adding multiple vehicles.

Example:

Meet Sana. She just bought her first car — a compact hatchback — and has no clue what her insurance should cost. Instead of calling five different companies, she opens Free Calculation Tools, enters her details, and within seconds gets an estimate. She tweaks a few options — adds comprehensive coverage, adjusts her deductible — and sees the total shift instantly. Sana now walks into the insurance office confident, armed with numbers that make sense.

That’s the kind of clarity this tool delivers: instant peace of mind.

Comparison Table

Here’s a quick snapshot of why using a calculator is smarter than going the old-fashioned route:

| Feature | Manual Calculation | Free Calculation Tools |

|---|---|---|

| Time Required | 30–40 minutes | Under 1 minute |

| Accuracy | Depends on your math | 99 % precise estimate |

| Ease of Use | Complicated forms | Simple fields + auto updates |

| Cost | Free but time-consuming | Completely Free |

| Transparency | Limited insight | Full breakdown of cost factors |

Notice how the difference isn’t just about speed — it’s about confidence. With manual math, you’re constantly second-guessing yourself. With a calculator, you know exactly why a certain figure appears and what you can do to lower it.

CTA Placement (Natural Transition)

🚗 Try it now: Head to Free Calculation Tools and test your car insurance cost estimator in seconds — no sign-up, no hassle.

FAQs About the Car Insurance Calculator

You’ve probably got a few questions — totally normal. Let’s go over the ones people ask most before using the car insurance calculator on Free Calculation Tools.

1. How accurate are car insurance calculators?

Pretty close. While the calculator doesn’t replace an official quote from your insurer, it gives you a strong ballpark figure. The algorithm uses real-world averages based on car type, driver profile, and region. Most users find their final policy price falls within the same range the calculator predicts — so it’s a solid starting point for decision-making.

2. Is my personal data safe?

Absolutely. The insurance cost estimator on Free Calculation Tools doesn’t store or sell any data. You’re not asked for private details like ID numbers or phone contacts — just general info needed for the calculation. Once you close the tab, your input is gone.

3. Can I compare different cars or drivers?

Yes! That’s one of the coolest things about this tool. You can run unlimited comparisons — switch car models, change cities, or even test how a younger driver affects the price. It’s perfect for families with multiple vehicles or anyone considering an upgrade.

4. How can I lower my estimated car insurance cost?

A few small changes make a big difference:

- Raise your deductible a little — your monthly premium usually drops.

- Bundle policies if possible (home + car).

- Maintain a clean driving record.

- Skip unnecessary add-ons that don’t fit your lifestyle.

The calculator helps you test each tweak instantly, so you’ll see the financial impact before you commit.

5. Is this tool free to use forever?

Yep — it’s in the name. Free Calculation Tools means exactly that. You can use the car insurance cost estimator anytime, anywhere, without sign-ups or payments.

Final Thoughts + CTA

Let’s be honest — nobody enjoys shopping for car insurance. It’s usually a confusing mix of fine print, unpredictable quotes, and that constant feeling you might be overpaying. The good news? A car insurance calculator changes all of that.

Instead of relying on guesswork or endless agent calls, you can see your real numbers in seconds. You understand what affects your premium — and you get the power to control it. That’s not just convenience; it’s confidence.

When you use Free Calculation Tools, you’re not jumping through hoops or handing over sensitive data. You’re simply using technology to make smarter financial choices. Every time you adjust a slider or try a new coverage option, you’re learning something about how the system works — and saving yourself from costly surprises later.

Picture this: you’re sitting at your desk or scrolling on your phone, curious about what switching to comprehensive coverage might cost. In under a minute, you’ve got an estimate, a comparison, and a clear plan. No calls. No waiting. Just results.

If more drivers used tools like this before renewing their policies, there’d probably be fewer horror stories about overpriced insurance. Because now you can double-check every claim, every quote, and every promise — instantly.

So the next time someone complains about “confusing car insurance rates,” you’ll know the secret weapon: a simple online calculator that does the hard math for you.

💡 Ready to find your real coverage cost?

Try the free car insurance calculator now on Free Calculation Tools — quick, accurate, and 100 % free.