How Much Can You Spend on a House Smartly?

If you’ve ever sat staring at house listings wondering, “Okay… realistically, how much can I spend on a house?” trust me, you’re not alone. Buying a home feels exciting at first—until you reach the part where numbers start jumping at you. Mortgage payments, interest rates, down payments, closing costs… honestly, it can get overwhelming fast.

But here’s the thing: calculating your true home affordability doesn’t have to feel like decoding rocket science. You just need a simple way to see what fits your income, your savings, and your monthly comfort zone. Most people don’t want a house that drains their wallet every month—they want something that feels safe, stable, and realistic.

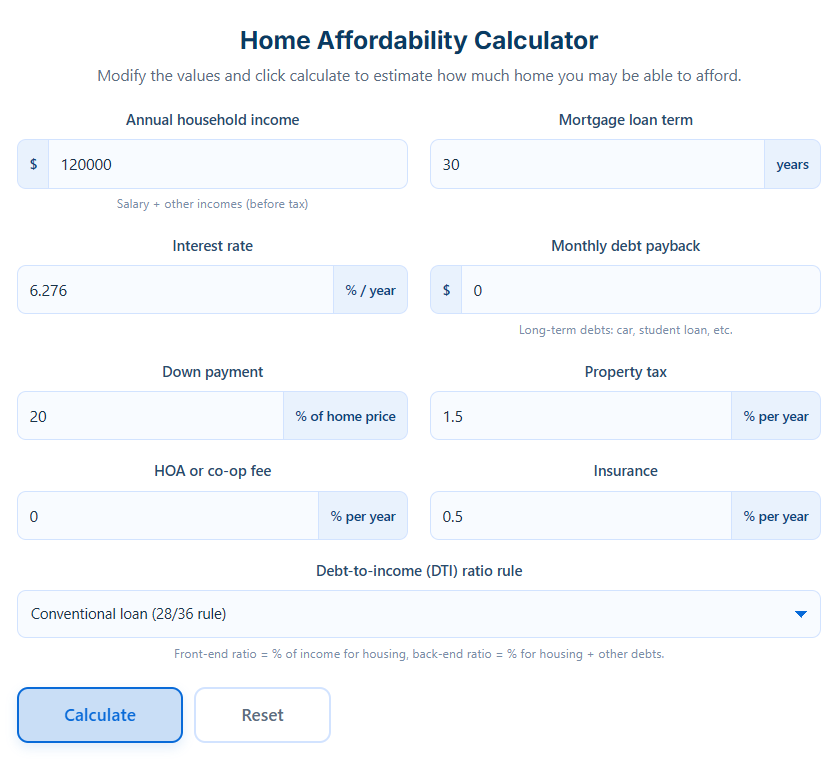

That’s exactly why tools like a home affordability calculator exist. They take the guesswork out and show you a clear number you can trust. And if you want something free, fast, and super clean to use, you’ll love the affordability tool on Free Calculation Tools (https://freecalculationtools.com/). It’s created to help you get straight answers without making things complicated.

This guide breaks everything down in a friendly way so you can understand what actually affects your home budget. You’ll learn how the calculator works, why the numbers matter, and how to finally get a confident answer to the question: how much can you spend on a house?

Whether you’re buying your first home, planning your next move, or just curious about where you stand, this article will help you see the full picture clearly. So, let’s get into it and make this whole “home affordability” puzzle feel a lot simpler than you ever expected.

What Is a Home Affordability Calculator?

A home affordability calculator is a simple online tool that helps you figure out the price range of homes you can realistically afford. Instead of guessing or hoping your budget works, this tool shows you an estimate based on your current financial situation. Think of it as your quick guide to knowing what’s safe, what’s realistic, and what might stretch you too far.

You’ll usually enter things like your monthly income, debts, down payment amount, and mortgage interest rate. After that, the calculator gives you a helpful number—a home price that fits your comfort zone.

Why do people love using it? Because it removes uncertainty. It helps you avoid falling in love with a house that will crush your monthly budget later. And honestly, it makes you feel more prepared before talking to lenders or scrolling through listings.

What makes this tool even more useful is how it looks beyond just income. It also takes into account your debt-to-income ratio, monthly expenses, and even how much you plan to put down. Those details matter because lenders use the same calculations when deciding your loan amount.

The affordability calculator on Free Calculation Tools focuses on simplicity. No confusing forms. No heavy jargon. Just clean inputs and clear results.

If you’re asking yourself “How much can you spend on a house?”, this is the easiest way to get an answer that’s actually meaningful and matched to your real-life situation.

How Does It Work?

Using a home affordability calculator is easier than you might think. You don’t need financial experience or fancy math skills. Everything is based on simple steps, and you’ll get your answer in seconds.

Here’s what you’ll typically do:

Step 1: Enter Your Monthly Income

You’ll add your total monthly income before taxes. This helps the calculator understand how much money you bring in every month.

Step 2: Add Your Monthly Debts

This includes things like credit card payments, personal loans, car loans, or student loans. These numbers affect your DTI (debt-to-income) ratio, which is one of the biggest factors in home affordability.

Step 3: Choose Your Down Payment

You can enter the exact amount or the percentage you plan to pay upfront. A larger down payment can help reduce your monthly mortgage, so it’s good to try different numbers here.

Step 4: Select Your Mortgage Rate

You’ll pick the interest rate based on current market rates. Even a small change in rates can shift how much house you can afford, so this part is important.

Step 5: Adjust Loan Term (Optional)

Most people use a 30-year loan, but you can choose 20-year or 15-year terms if you want to compare.

Once you hit calculate, the tool will instantly show you how much you can safely spend on a house. You’ll see your estimated monthly payment and a full breakdown so you understand exactly where the number comes from.

Key Features of the Home Affordability Calculator

A good home affordability tool should make your life easier, not harder. That’s why the calculator on Free Calculation Tools focuses on clarity, speed, and accuracy. You’ll never feel lost or confused while using it. Everything is designed around helping you get answers fast without unnecessary steps or complicated screens.

Here are the features that make the tool stand out:

1. Simple Input Fields

You only enter what matters: income, debts, interest rate, and down payment. Nothing extra. Nothing confusing.

2. Instant Calculations

The moment you click the button, your affordability estimate appears. No waiting. No loading bars. Just instant numbers.

3. Monthly Payment Breakdown

You’ll see how much of your payment goes toward principal and interest. This helps you understand what you’re really paying for.

4. Adjustable Loan Terms

You can switch between loan terms to compare how each one affects your home-buying budget.

5. Clean, Mobile-Friendly Layout

You can use the calculator on your phone, tablet, or laptop without any issues. Everything stays clean and readable.

6. Completely Free

No sign-up. No trial period. No subscription. You simply enter your information and get your results.

These features help you focus on what matters—figuring out how much you can spend on a house without stress, complications, or hidden requirements.

Benefits of Using Free Calculation Tools

When you’re making a huge decision like buying a home, you want the best tools possible. That’s where Free Calculation Tools really shines. It gives you everything you need to make smarter financial choices without paying a single cent.

First, the calculator is quick and easy. You don’t need to create an account, verify an email, or enter personal details. You simply use it. This makes it perfect for anyone who just wants information right away.

Second, the tool gives accurate and trustworthy results. It uses the same logic lenders follow when evaluating your affordability. That means you get a reliable estimate that helps you understand your real home budget.

Another big benefit is how user-friendly the design is. You won’t get lost in menus or overwhelmed by strange terms. Every part of the calculator is written in simple language so you can make sense of the numbers without stress.

Plus, it’s completely free forever. Many other online tools hide their results behind payment walls or trial pop-ups. This one doesn’t. You can conduct unlimited calculations without restrictions.

Using this calculator also helps you avoid common mistakes, like overestimating your home budget or ignoring how debts impact your mortgage approval. It’s honestly one of the easiest ways to get a solid answer to the big question: How much can you spend on a house?

So if you want a tool that’s simple, accurate, and totally free, this one is definitely worth using.

Who Can Use This Tool?

This affordability calculator is made for anyone who wants to understand their realistic home-buying power. It doesn’t matter whether you’re buying your first home or upgrading to something bigger—the tool works for everyone.

1. First-Time Homebuyers

If you’ve never bought a home before, this tool helps you understand your budget clearly. You won’t feel intimidated by mortgage math or confusing terms.

2. Growing Families

Families looking to upgrade often wonder if a bigger home fits their income. The calculator gives you a quick answer so you can plan confidently.

3. Professionals Planning Ahead

If you’re not ready to buy but want to see where you stand, you can use the tool to plan for the future. It’s great for long-term budgeting.

4. Students or Young Adults

Even if you’re just curious about your future affordability, the tool gives you a baseline. You’ll know what changes you can make to qualify for a better mortgage later.

Real-Life Examples

Imagine Sarah, a teacher earning a stable income. She wants to know whether she can afford a starter home. Instead of guessing, she enters her income and debts and gets a realistic home price instantly.

Or think about Mark and Layla, a couple planning to start a family. They want to know if upgrading to a three-bedroom home fits their budget. Using the calculator, they see exactly how much room they have financially.

Anyone who wants clarity, confidence, and guidance can benefit from this tool.

Comparison with Alternatives

There are tons of mortgage calculators online, but not all of them make things easy. Some require sign-ups. Some overload you with numbers. Others hide the results until you enter your email. That’s why comparing your options helps you see which tool actually respects your time.

Below is a simple comparison to show how Free Calculation Tools stacks up against two common alternatives:

Comparison Table

| Feature | Free Calculation Tools | Bank Affordability Calculator | Finance App Calculator |

|---|---|---|---|

| Free to Use | ✔ Always Free | ✔ Free, but limited | ✖ Often requires account |

| No Sign-Up | ✔ No sign-up needed | ✖ Usually required | ✖ Mandatory |

| Easy Inputs | ✔ Very simple | ✖ More complex forms | ✔ Simple |

| Instant Results | ✔ Yes | ✔ Yes | ✔ Yes |

| Mobile-Friendly | ✔ Fully responsive | ✔ Good | ✖ Not always |

| Clean Interface | ✔ Minimal & clear | ✖ Sometimes cluttered | ✔ Clean |

Why This Tool Wins

The biggest difference is convenience. Free Calculation Tools doesn’t make you jump through hoops. Everything is easy and open from the moment you land on the page.

Bank calculators might be accurate, but they often require you to enter detailed financial history or log in to your account. Finance apps look modern but usually require creating profiles, subscribing, or dealing with ads.

With Free Calculation Tools, the goal is simple: help you understand how much you can spend on a house without slowing you down.

Whether you’re planning ahead or ready to buy right now, this calculator makes the entire process smoother and less stressful.

Frequently Asked Questions

Buying a home naturally comes with questions, and that’s completely normal. Here are some of the most common things people ask when trying to figure out how much they can spend on a house using a home affordability calculator.

1. Is this tool really free to use?

Yes. The calculator is completely free with no sign-up and no hidden fees.

2. How accurate are the results?

The tool uses standard mortgage formulas based on income, debts, and interest rates. While it gives a reliable estimate, your final loan approval may vary slightly depending on your lender.

3. Will using the calculator affect my credit score?

Not at all. You’re simply entering numbers and viewing results. There’s no credit check involved.

4. What if my income changes later?

You can redo the calculation anytime. Just enter your updated income and debts to get a fresh estimate.

5. Are there limits on the home price it can calculate?

No. You can test any scenario—from small starter homes to larger properties—to see how different numbers affect your affordability.

6. Is my data saved or stored?

No personal data is saved. The tool doesn’t collect or store anything you enter.

7. Can I use this calculator for joint income?

Yes. Simply add both incomes together for a combined affordability estimate.

8. Does it tell me the exact loan amount I’ll get?

It gives a very close estimate, but your lender has the final say. Still, it’s a great way to prepare and avoid surprises.

These quick answers help you use the tool with confidence and understand what’s possible for your next home.

Buying a home is one of the biggest decisions you’ll ever make, and knowing how much you can spend on a house is the first step toward making that decision stress-free. Instead of guessing or relying on rough estimates, a home affordability calculator gives you numbers you can trust. It shows you a clear picture of your financial comfort zone, helps you avoid overspending, and gives you confidence before you even speak to a lender.

The calculator on Free Calculation Tools brings everything together in one clean, easy-to-use place. It’s fast, simple, and free—exactly what you need when you want honest answers without complications. Whether you’re planning months ahead or getting ready to make an offer soon, the tool helps you focus on what truly matters: finding a home that fits your life and your budget.

So, here’s your next step. Take a minute, gather your numbers, and try the home affordability calculator for yourself. You’ll be surprised at how quickly the entire process becomes clear. You’ll see your estimated home price, monthly payment, and full breakdown—all in seconds.

If you’re ready to feel confident about your next move, go ahead and check your home affordability now. It only takes a few moments, and it could save you from making costly mistakes later.

Your future home starts with knowing what you can afford. Try the calculator today and step forward with clarity.