Build Real Wealth Using a SIP Investment Calculator

There’s something quietly powerful about setting money aside every month and watching it grow. It’s not dramatic. It doesn’t make headlines. But over time, it can change your life.

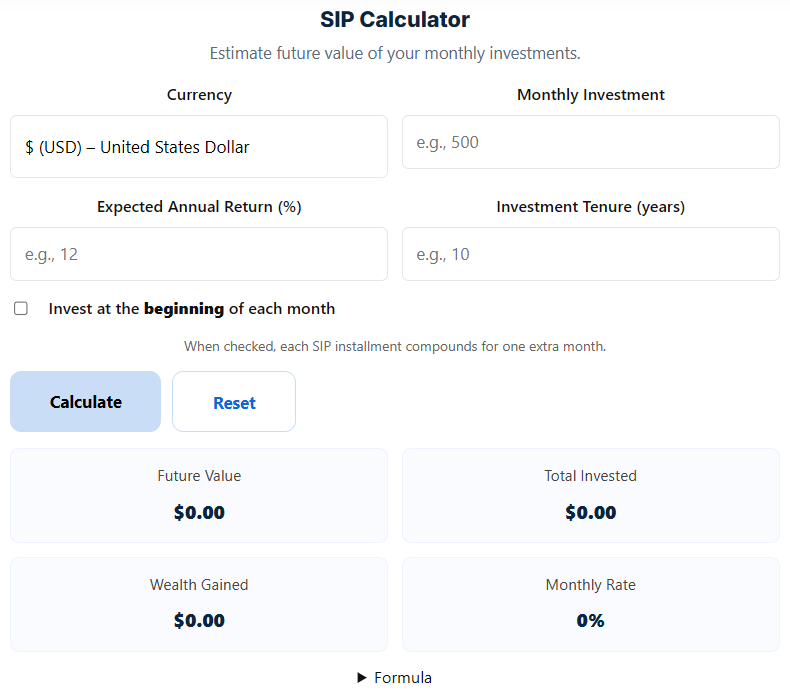

That’s the story behind the Systematic Investment Plan, or SIP. And if you’ve ever wondered how much your monthly investments could turn into after a few years, there’s a simple way to find out — the Systematic Investment Plan Calculator on Free Calculation Tools.

This isn’t some cold financial device. It’s a window into your future savings — showing what’s possible when consistency meets time.

Let’s walk through it together, like a conversation about money between two friends — no jargon, no stress, just clarity.

What Is a Systematic Investment Plan?

Imagine this: instead of saving up a huge amount to invest all at once, you invest a small amount every month — say $100 — into a mutual fund or another investment plan. That’s what a Systematic Investment Plan (SIP) does.

It’s not about guessing when the market will rise or fall. It’s about forming a habit — investing regularly and letting compounding do the heavy lifting for you.

A Systematic Investment Plan Calculator helps you figure out where that habit could lead. You enter how much you invest each month, for how long, and at what return rate you expect. The calculator then shows you the total you’ll have at the end — your own personal “future snapshot.”

It’s like peeking into your financial future — but without the spreadsheets.

Why People Use a SIP Calculator

Money can feel abstract. You know you should save and invest, but it’s hard to stay motivated when you can’t see results right away.

That’s where this calculator shines. It makes the invisible visible.

When you see that your $100 a month could become $35,000 in 15 years — or that starting five years earlier could double your final amount — it suddenly clicks.

That “oh, wow” moment turns into action.

At Free Calculation Tools, that’s the whole point — to help you understand your money’s potential through simple, easy-to-use calculators that don’t require you to be a finance expert.

How the SIP Calculator Works (in Plain English)

Let’s break this down.

The Systematic Investment Plan Calculator takes three main inputs:

- Your monthly investment – how much you plan to put in regularly.

- The time period – how long you’ll keep investing (in years).

- The expected return rate – what average annual return you hope to earn.

Once you plug those in, the calculator instantly gives you:

- Total invested amount – how much you actually contributed.

- Estimated returns – how much your money grew.

- Total future value – what your investment could be worth at the end.

It’s that simple. You don’t need to memorize formulas or open Excel. Just type, click, and get clarity.

And yes — it’s free, fast, and works perfectly on any device.

The Simple Math Behind the Magic

Here’s a little peek under the hood (without going full math nerd):

SIPs use a concept called compound interest. That means you earn returns not just on your original money, but also on the returns you’ve already earned. It’s “interest on interest,” and it grows faster than most people realize.

For example:

If you invest $200 per month for 10 years at 12% annual returns, your total contribution is $24,000. But thanks to compounding, you could end up with around $46,000.

That’s almost double — and you didn’t increase your investment, just your patience.

Albert Einstein supposedly called compounding “the eighth wonder of the world.”

After you see it in action, you’ll understand why.

Who Can Use It? (Spoiler: Everyone)

One of the best things about the SIP Calculator is that it’s for everyone. You don’t need fancy software or a financial background. If you can type numbers, you can use it.

Here’s who benefits the most:

- Students – learning how early savings grow faster than late savings.

- Professionals – figuring out how much to invest monthly to hit goals.

- Parents – planning long-term funds for their children.

- Retirees – testing how different return rates affect savings longevity.

- Teachers and trainers – demonstrating compound interest in classrooms.

Take this example:

Fatima, a 27-year-old graphic designer, wanted to know if her small $150 monthly SIP was even worth it. She used the calculator and found out that by 47, she could have over $100,000 — just by staying consistent. No big risks. No stress. Just time and discipline.

Why Choose Free Calculation Tools

Let’s be honest — there are hundreds of calculators on the internet. So why use this one?

Because it’s designed by people who get it. At Free Calculation Tools, we believe good tools should make your life simpler, not more complicated.

Here’s what makes this SIP Calculator stand out:

- Zero clutter: No sign-ups, ads, or confusing dashboards.

- Accurate formulas: Based on trusted financial principles.

- Lightning-fast results: You get your future value in seconds.

- Completely free: No hidden fees, no limits.

- Educational touch: Great for students or anyone learning finance basics.

We’re not here to sell you anything. We’re here to help you understand — so you can make better choices for your financial future.

👉 [Insert internal link to related tool, e.g., “Compound Interest Calculator” here.]

Real-Life Lesson: The Power of Starting Early

Here’s something many people don’t realize — the biggest factor in building wealth isn’t how much you invest, it’s how long you invest.

Let’s say two friends, Aisha and Ahmed, both invest $200 a month.

- Aisha starts at 25.

- Ahmed starts at 35.

They both earn 10% annual returns and stop investing at 55.

Aisha’s total investment: $72,000 → grows to about $455,000.

Ahmed’s total investment: $48,000 → grows to about $170,000.

Same plan, same amount — but starting 10 years earlier made Aisha over $280,000 richer.

That’s what the SIP Calculator helps you see — how time quietly multiplies your efforts.

SIP Calculator vs Traditional Methods

| Aspect | Free Calculation Tools SIP Calculator | Manual or Traditional Method |

|---|---|---|

| Speed | Instant calculation | Slow, manual formula work |

| Cost | Free forever | Requires software or books |

| Ease of Use | Beginner-friendly | Requires financial knowledge |

| Accuracy | Uses standard financial formulas | Depends on manual input |

| Access | Online, 24/7 | Limited to device or offline tools |

| Visuals | Clean, clear results | Numbers only, no comparison charts |

Using our calculator feels like using GPS — it tells you exactly where you’ll end up if you stay on track.

Common Questions About SIP Calculators

1. How reliable are the results?

Very reliable. The calculator uses the same logic mutual fund experts use for return projections. Of course, markets vary — but the math is solid.

2. Do I need any prior financial knowledge?

Not at all. The tool is made for beginners. You just enter three simple numbers and see your result instantly.

3. Can I test different scenarios?

Yes! You can change your investment amount, duration, or return rate as often as you want to explore what fits your goals best.

4. Is it free to use?

Completely free. We don’t collect data or charge for access.

5. What’s the best return rate to assume?

If you’re investing in equity-based mutual funds, most people use 10–12% as a conservative estimate. For safer options, you might try 6–8%.

Tips to Get the Most Out of Your SIP

Here’s what most long-term investors swear by:

- Start small, but start early. Even $50 a month adds up.

- Increase your SIP yearly. A small raise (like 5%) keeps up with inflation.

- Stay consistent. Don’t stop when markets fall — that’s when you buy more units cheaply.

- Review once a year. Check your goals, adjust if needed, and keep going.

- Think long-term. SIPs work best when you let time do its magic.

The SIP Calculator helps you visualize all of this in real numbers — so decisions become easy, not emotional.

A Quick Reality Check

Financial growth isn’t about luck. It’s about consistency.

And the Systematic Investment Plan Calculator helps you build that consistency into something real — something measurable. It gives you control over your own story instead of guessing.

When you see your numbers on-screen, you realize that building wealth isn’t some mystery reserved for the rich — it’s a simple formula available to anyone who sticks with it.

Final Thoughts: Small Steps, Big Future

The beauty of investing through SIPs is that you don’t need to make big, risky moves. You just need to take small, steady steps.

The Systematic Investment Plan Calculator on Free Calculation Tools turns those steps into a clear picture of where you’re headed — and how small changes can make a huge difference.

It’s free, quick, and takes less than a minute to use.

But it could change the way you think about money forever.

So go ahead — try it now.

👉 Use the Systematic Investment Plan Calculator and see how your dreams start turning into numbers that make sense.

Because in the end, wealth isn’t built in a day.

It’s built every month — one SIP at a time.

Written by Amir Shahzad

Founder of Free Calculation Tools